Manna Guidelines

Manna Christian Disability Sharing

*Manna Christian Disability Sharing is no longer available as of August 1, 2024.

+ I. Manna Standards and Purpose

A. Bringing Believers Together

B. Manna is Not Insurance

C. Modification of the Guidelines – Your Vote Counts

A. Bringing Believers Togethers

Christian Care Ministry, Inc. (CCM) brings believers together to share the blessings God has bestowed on them according to the example of Scripture and the early Christian Church. Manna brings Christians together to help one another during a time of disability. CCM facilitates sharing directly between members who have volunteered in faith to assist one another when a member has a need for income replacement resulting from an eligible disability.

Back to Top

B. Manna is Not Insurance

While Manna exists to assist its members in time of disability, just as with church benevolence programs, there is no guarantee that assistance will be available. Therefore, neither CCM nor Manna members shall be held liable for any part of a person's financial obligations. Each member remains individually liable and responsible for their financial obligations at all times. Manna is not disability insurance, nor is it guaranteed in any way. Manna is not, and should never be construed as, a contract for insurance or a substitute for a contract guaranteeing disability insurance. CCM shall not be held liable for a failure to replace any part of a member's income.

There is no transfer of risk from a member to CCM or from a Manna member to the other Manna members. All such sharing of a member's need is on a voluntary basis only. All money comes from the voluntary giving of Manna members, not from CCM itself.

Back to Top

C. Modification of the Guidelines – Your Vote Counts

The Manna program is governed by the Manna Guidelines (hereinafter referred to as Guidelines). Members may vote on material revisions to the Guidelines such as eligibility requirements and the sharing limits. Changes to the Guidelines are made if 67% or more of the members that vote are in favor of the change. Changes to the Guidelines may also be made by CCM's Board of Directors. Any change to the Guidelines made by the CCM Board of Directors will be effective immediately or at the date specified by the Board of Directors. In the event that CCM's Board of Directors materially modify the Guidelines, such as, changing eligibility requirements or the amount to be shared, members must ratify such modification by affirmative vote of 67% or more of the members that vote within 12 months of the modification. If members fail to ratify the modification within the 12 month period, then the Guidelines will revert to their prior form effective on the date that the members failed to ratify it or after 12 months from the date of the change, whichever comes first.

The Guidelines are definitive and will overrule verbal statements made by anyone regarding Manna. The current Guidelines govern, not the Guidelines that were in effect when a person joins. The most current Guidelines appear on the Christian Care Ministry website at www.MyChristianCare.org/manna.

+ II. Definitions

Member – The individual who meets the application qualifications for the Manna Program and abides by the requirements for membership.

Recipient – A member who submits an eligible need and receives assistance from other Manna members.

Need – The loss of a member's taxable earned income due to the inability to perform the material and substantive duties of his/her occupation or occupations as a result of an illness or injury.

Monthly financial assistance – the approved dollar amount to replace lost income based on total taxable earned income and units elected. The actual amount of monthly financial assistance is dependent on monthly shares contributed by members.

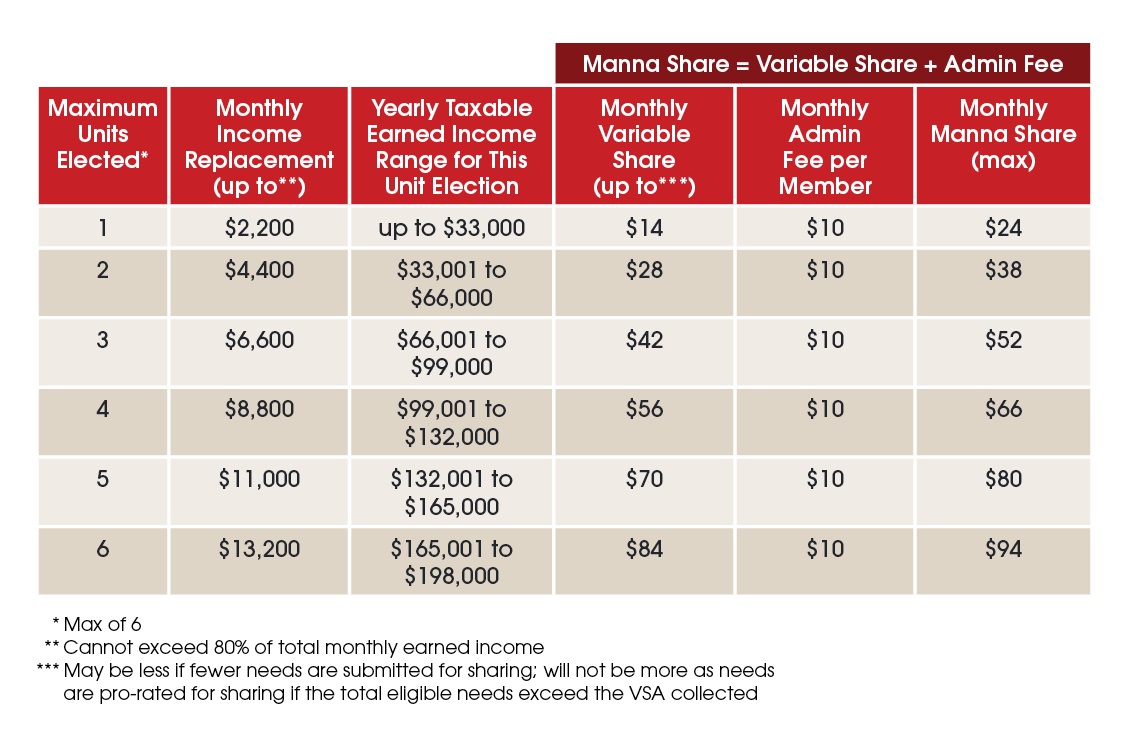

Monthly share – The combination of the $10 administrative fee and the variable share amount for each unit elected.

Taxable earned income - wages, salaries, tips and other taxable employee pay as well as net earnings from self-employment.

Unit – $2,200 of monthly financial assistance not to exceed 80% of the member's total taxable earned income.

Variable share amount (VSA) – the amount each member commits to, based on number of units elected, which is used to assist other Manna members.

+ III. Qualifications for Membership

A. Christian Testimony

B. Healthy Lifestyle

C. U.S. Citizenship or legal residents

D. Age

E. Employment Status

A. Christian Testimony

All members must have a verifiable Christian testimony indicating a personal relationship with the Lord Jesus Christ and profess the following Statement of Faith:

- I believe that there is only one God eternally existing in three Persons: the Father, Jesus Christ the Son, and the Holy Spirit. I believe Jesus is God, in equal standing with the Father and the Holy Spirit.[1]

- I believe the Bible is God’s written revelation to mankind, divinely given through human authors who were inspired with the Holy Spirit. It is completely authoritative, and entirely true.[2]

- I believe in the deity of Jesus Christ who existed as God before anything was created, His virgin birth, sinless life, miracles, death on the cross to provide for our redemption, bodily resurrection and ascension into heaven, present ministry of intercession for us and His return to earth in power and glory. He is the world’s only Savior and is the Lord of all.[3]

- I believe in the personality and deity of the Holy Spirit, that He performs the miracle of new birth in an unbeliever and indwells believers, enabling them to live a godly life.[4]

- I believe man was created in the image of God, but because of sin was alienated from God. Alienation can be removed by accepting God's gift of salvation by grace through faith which was made possible by Christ's death and resurrection. This faith will be evidenced by the works that we do.[5]

[1] Deuteronomy 6:4, Matthew 28:19, Colossians 1:15-20, 2:9

[2] 2 Timothy 3:16

[3] John 1:1,Matthew 1:23, Hebrews 4:15, 1 Peter 2:24, 1 Corinthians 15:3-8, Hebrews 7:24-25, Matthew 24:30, John 14:6, Acts 4:12, Isaiah 45:21-23

[4]Acts 5:3-4, 1 Corinthians 3:16, Romans 8:14

[5] Ephesians 2:8-10, James 2:17, 26

A leader from your church may be interviewed to verify your testimony.

All members agree to the following:

- Live by biblical standards

- Believers are to bear one another's burdens

- Attend and actively support a fellowship of believers regularly

B. Healthy Lifestyle

Members highly value the biblical principle that our physical bodies are temples of the Holy Spirit and should be kept pure. Members should strive to maintain healthy lifestyles, as this glorifies God and keeps medical costs down. Examples of unhealthy lifestyles include, but are not limited to, the following:

- Use of tobacco

- Use of illegal drugs

Applicants need to have abstained from the use of tobacco or illegal drugs for at least the 12 months prior to application in order to be eligible for membership. Members cannot use any tobacco products or their membership will be cancelled.

Applicants attest that they have not abused legal drugs, such as prescriptions or over-the-counter medication, or alcohol for at least the 12 months prior to application in order to be eligible for membership. Members must only engage in sexual relations within a traditional Christian marriage.

Back to Top

C. US Citizenship or legal residents

A member must be a U.S. citizen or a legal resident. U.S. citizens who do not live full time in the U.S. may qualify provided they have filed a U.S. tax return in the previous year. Legal U.S. residents must have a green card or immigrant visa, a social security number, and live full-time in the United States to qualify for the Manna Program. On the day that a member ceases to be a legal U.S. resident, he or she no longer qualifies for the Manna Program.

D. Age

Applicants must be between the ages of 18 and 70. However, if a member turns 71, and is still employed, they can continue to participate in the Manna program through age 75.

Back to Top

E. Employment Status

Applicants and members must be employed in some capacity to participate in this Christian disability sharing program.

Retirement income, or other passive income such as rental or investment income, is not considered employment and is not taxable earned income.

+ IV. When You Have a Disabling Event/Condition

A. Manna Sharing

B. Changing Units Elected

C. Needs Determination

D. Submitting a Need

E. Taxable Earned Income Verification

F. Manna is Secondary to Other Sources of Income Replacement

G. Withdrawals and Cancellations

H. Reapplication after Withdrawal

A. Manna Sharing

Each member contributes monthly an administrative fee, which is used by CCM to administer the program, and a Variable Share Amount (VSA) per unit elected, which is used to assist other members. Each unit elected represents up to $2,200 of monthly financial assistance not to exceed 80% of the total taxable earned income. Total taxable earned income includes: wages, salaries, tips and other taxable employee pay as well as net earnings from self-employment.

The recipient's VSA and monthly administrative fee are waived for each month that they receive assistance from other members as a result of a disability. Sharing is accomplished by communicating the needs of members suffering from eligible disabilities to other members who send their monthly Manna share to CCM. CCM then forwards the total VSA collected to those members in need.

The partial replacement of actual taxable earned income lost due to an illness or injury will be presented to Manna members for sharing for up to 12 months. Up to 80% of the recipient member’s verifiable lost taxable earned income will be presented for sharing. Further, if in a given month the total eligible needs exceed the VSA collected, the needs are shared on a prorated basis.

Back to Top

B. Changing Units Elected

Members can change the number of units elected at any time, but must apply in writing to do so. If the request to change is submitted on or before the15th of the month, the start date for that unit level will be the first of the following month. However, if the request is received after the 15th of the month, the start date will be the first day of the second month following the request.

Back to Top

C. Needs Determination

1. Eligibility

The following factors are considered to determine eligibility.

- The event/condition must have been treatment free, symptom free, and medication free for 12 months prior to joining Manna and 90 days thereafter. Exception: if an otherwise eligible accident-related injury occurs within the first 90 days of Manna membership, it will be considered for sharing.

- If the member has increased their unit level during their Manna membership, the event/condition must have been treatment free, symptom free, and medication free for 12 months prior to the start date of the new unit level and 90 days thereafter in order to be shared at the new unit level.

- If the member decreases their unit level, there is no waiting period and sharing will be at the lower level of units elected, provided they have been a member for at least 90 days.

- Income must be lost because of the inability to perform the material and substantive duties of the member's occupation due to illness or injury.

2. Events/Conditions Not Eligible for Sharing

- The following events/conditions are not eligible for sharing: elective cosmetic surgery, mental illness and depression, pregnancy, chronic fatigue syndrome, chronic pain, fibromyalgia, Epstein Bar Syndrome, causes from acts of war, and Lyme Disease.

- The following events/conditions will not be eligible for sharing unless surgery is involved: carpal tunnel syndrome, back injuries, and knee injuries. For instance: the member has been diagnosed with carpal tunnel and the doctor states surgery is required. The event/condition will then be eligible after surgery is performed.

- A need will not be eligible for disability sharing if the member is able to return to work full-time within 61 days of the disabling event.

3. Timing of Sharing

- A need is eligible for sharing once the member has lost income for 60 consecutive days, however, the Request for Financial Assistance should be promptly submitted (see Section D. below). Financial assistance for an eligible need will be presented to the members for sharing beginning on the 61st day following the first day the income was lost. An exception will be made for a disabled member under hospice care, who will be eligible for disability sharing based on the day they enter hospice care, provided they have been a member at least 90 days.

- Checks will be issued to eligible recipients at least once a month, subject to Section V. (A) above, provided other members send in their VSA.

- Financial assistance ends when recipient is able to return to work full-time or after 12 months of receiving disability sharing, whichever comes first. A new incident of the same nature will be considered for eligibility 12 months after the previous incident's sharing period has ended.

Back to Top

D. Submitting a Need

To request sharing assistance, the disabled member must submit a “Request for Financial Assistance” (RFA) packet, which includes sections for the member (employee), employer, and physician to complete.

- Member RFA—submit within 30 days of the disabling event to start the verification process;

- Physician RFA—submit as soon as possible, but no later than 60 days following the disabling event;

- Employer RFA—submit as soon as possible, but no later than 60 days following the disabling event.

These forms can be downloaded from www.MyChristianCare.org or requested by calling Member Services at (800) 264-2562.

CCM relies on the medical and lifestyle information provided on the RFA forms and during the subsequent information gathering process to determine whether or not a member qualifies for Manna financial assistance. It is important to note that a need cannot be determined eligible for disability sharing if these forms are incomplete or not submitted in a timely basis. If all information requested is not received within 120 days from the date the Member RFA is received, the need will be determined ineligible for sharing.

Failure to disclose medical or lifestyle information that might disqualify the member may result in termination from the Manna program. If terminated, no refund of shares will be issued. If a member recalls or becomes aware of any medical history that was not reported on the RFA forms or during the subsequent information gathering process, that information should be immediately submitted in writing to CCM.

Back to Top

E. Taxable Earned Income Verification

The recipient must demonstrate recent taxable earned income and must supply any documents requested by CCM to determine the amount of income lost within 60 days of the disabling event. These documents may include:

- Completed income tax forms for at least the last two years (such as W-2, 1040, 4506, 1099),

- Filed quarterly income tax return (if applicable),

- Most recent pay stubs.

You will also be asked to request an IRS tax transcript using the form that is available on the Member website. The IRS tax transcripts must be received no later than 90 days from the disabling event.

Total taxable earned income can be found on the 1040 (lines 7 and 12), Schedule C (line 31), or 1040 EZ (line 1). If self-employed and the company is not a sole proprietorship then the form 1065 will be required for determination of total taxable earned income.

Back to Top

F. Manna is Secondary to Other Sources of Income Replacement

Compensation received by a recipient (after the waiting period) from benefits such as disability insurance, worker's compensation, state or federal programs, fraternal benefits, or any other resources designed to supplement all or part of income lost due to an injury or illness will be deducted from the assistance amount. These benefits must be exhausted first. The recipient agrees to report such sources of other income and to cooperate fully with CCM staff to determine and obtain any other sources.

Back to Top

G. Withdrawals and Cancellations

All withdrawals or cancellations are effective on the first of the month. If a member wishes to withdraw, please inform CCM by mail, e-mail or fax at least 15 days prior to the desired effective month. United States mail should be addressed to Christian Care Ministry, Attn: Manna, P.O. Box 121505, West Melbourne, FL 32912. E-mails may be sent to manna-finance@tccm.org and letters may be faxed to (321) 722-5139.

The foregoing notwithstanding, if a member fails to submit their monthly share for two consecutive months, CCM will take this as an indication that the member desires to withdraw from Manna and his or her membership will be cancelled effective at the end of the month for which he or she last submitted a monthly share.

Back to Top

H. Reapplication After Withdrawal

A member who has withdrawn must re-apply for the Manna program by paying the $50 application fee and submitting to the full application process and review.

+ V. What Is Expected of Members

A. Sharing Faithfully Each Month

B. Praying and Extra Sharing

C. Adherence to Lifestyle Requirements

A. Sharing Faithfully Each Month

Faithful sharing makes it possible for members with financial needs to continue with their current financial responsibilities in spite of their inability to work. Every member receives notice of the monthly share amount that is due before the twentieth of each month.

Back to Top

B. Praying and Extra Sharing

Members are encouraged to pray for these members and their families. They may also wish to send cards, letters, or emails of encouragement as many have expressed how blessed they are by their fellow members who take the time to contact them. The names and addresses of the recipients assigned to receive monthly shares are published on the monthly share notice.

To review or post prayer needs, visit PrayerStream

Members can give over and above their specified sharing amount to help another member in need by sending an additional amount with their share payment and mark their monthly share notice to share the extra amount.

Back to Top

C. Adherence to Lifestyle Requirements

When applying, applicants must read and agree with the terms in the application regarding certain lifestyle requirements. These requirements includerefraining from sexual relations outside of traditional Christian marriage, no use of tobacco or illegal drugs in any form, or abuse of legal drugs, including alcohol. If a member chooses not to live by these lifestyle requirements, they will be disqualified and his or her needs will not be eligible for sharing.

+ VI. Appeals

If a member believes that a medical or financial eligibility determination of a need was inaccurate within the provisions of the Guidelines, a signed appeal letter may be submitted to Christian Care Ministry, Attn: Manna, PO Box 121505 , West Melbourne FL 32912 or faxed to (321) 308-7779. The appeal will be presented to an “Appeal Panel”, which models the biblical pattern of Matthew 18:15-20. The determination of the Appeal Panel shall be final and binding on CCM.

Should a member disagree with the determination of the Appeal Panel, the parties agree to be bound by the following mediation and binding arbitration agreement in an attempt to resolve issues and bring reconciliation.

A. Mediation and Arbitration

B. No Conflicts of Interest

The parties to this agreement are Christians or Christian organizations and believe that the Bible commands them to make every effort to live at peace and to resolve disputes with each other in private or within the Christian community in conformity with the biblical injunctions of 1 Corinthians 6:1-8, Matthew 5:23-24, and Matthew 18:15-20. Therefore, the parties agree that any claim or dispute arising out of, or related to, this agreement or any aspect thereof, including claims under federal, state, and local statutory or common law, the law of contract, and law of tort, shall be settled by biblically based mediation.

If resolution of the dispute and reconciliation do not result from mediation, the matter shall then be submitted to an independent and objective arbitrator for binding arbitration, with each party to bear their own costs and attorney's fees, and with the cost of arbitration itself to be borne by CCM. The parties agree that the mediation and arbitration process will be conducted in accordance with the “Rules of Procedure for Christian Conciliation” (“Rules”) contained in the Peacemaker Ministries booklet Guidelines for Christian Conciliation. Consistent with the Rules, each party to the agreement shall agree to the selection of the arbitrator. The parties agree that if there is an impasse in the selection of the arbitrator, the Institute for Christian Conciliation, a division of Peacemaker Ministries in Billings, Montana (406-256-1583), shall be asked to provide the name of a qualified person who will serve in that capacity. Consistent with the Rules, the arbitrator shall issue a written opinion within a reasonable time.

The parties agree that these methods shall be the sole remedy for any controversy or claim arising out. The parties agree that these methods shall be the sole remedy for any controversy or claim arising out of this agreement, and they expressly waive their right to file a lawsuit against one another in any civil court for such disputes, except to enforce a legally binding arbitration decision for the reasons stated.

Back to Top

B. No Conflicts of Interest

CCM does not gain financially in any way by determining that a financial need is eligible or ineligible for sharing. CCM is a not-for-profit ministry and no person owns all or part of CCM. CCM impartially carries out the wishes of the members as expressed in the Manna Guidelines.

-

-

-

-

1-800-PSALM-23